According to a new report from RBC, the start of 2023 in Canada’s housing market has been a continuation of the quiet trend seen at the end of 2022.

In the company’s latest special housing report, Robert Hogue, assistant chief economist with RBC, notes that January results from some of Canada’s real estate boards show persistent weak activity and price declines across the country, with few exceptions.

Calgary remains one of the few markets where demand and supply conditions remain “remarkably tight,” though sales volume is down from last year’s “sky-high” levels.

Hogue writes the Bank of Canada’s aggressive rate hike campaign has been a major factor in the slowdown, with many buyers no longer qualifying for mortgages and others seeing a significant reduction in their budgets.

Rapid rise and fall

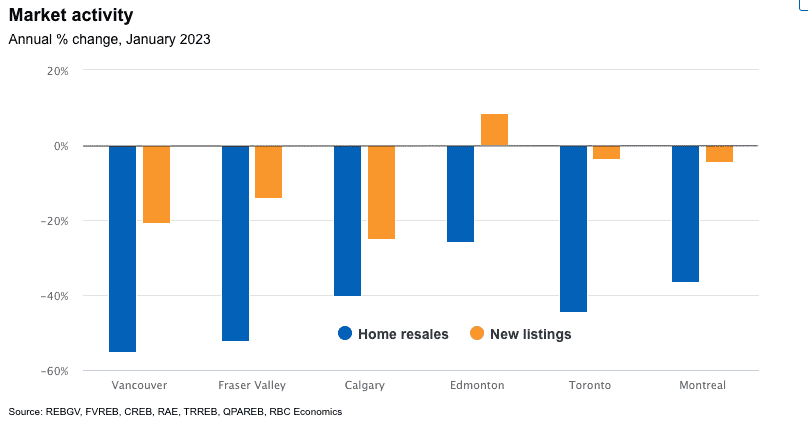

High-priced markets and areas that experienced rapid growth during the pandemic have seen the most significant drops. According to the report, home resales have plummeted by at least 45 per cent in Vancouver, Toronto and their surrounding regions over the past year; price drops have also been the largest in these markets.

However, Hogue says the correction seems to be easing, with monthly rates of decline slowing in recent months in Ontario (including Toronto), British Columbia (including Vancouver), and other markets.

Cyclical bottom in sight

With the Bank of Canada expected to have completed its rate hike campaign, a cyclical bottom is anticipated in the spring or summer, although the timing may vary market to market, according to the report.

RBC economists expect the recovery to be gradual at first, with the increase in interest rates continuing to hold back activity and purchasing power for some time.

Regional insights

Toronto area

Hogue explains the intense cooldown in the Toronto-area market has resulted in the quietest resale activity in 14 years (excluding the lockdown period) and a slowdown in price appreciation.

While the slide in activity has slowed over the past few months, RBC expects the price correction may continue.

According to the report, the MLS HPI has declined for 11 consecutive months but has only reversed a third of its 57 per cent pandemic-era gain. RBC economists expect buyers will continue seeking more affordable options, leading to further price reductions to fit their budgets.

Montreal area

The slowdown has picked up since late summer, with January resales the weakest since 2009, down 11 per cent from December on a seasonally-adjusted basis, per the report.

Median prices for condos and single-family homes have declined 10 per cent and 14 per cent, respectively since April; economists expect price erosion to continue in the near term.

The increase in inventory has resulted in demand-supply conditions no longer favouring sellers. The decline in affordability is putting buyers on edge, and a weakening economy may also be a concern.

RBC expects it will take some time for confidence to rebuild and market trends to stabilize.

Vancouver area

Vancouver’s housing market is experiencing a decline in both prices and resale activity. Economists note prices are on a 10-month decline, and resales near their lowest point since the global financial crisis (excluding the lockdown period).

Despite an increase in listings, resales dropped another seven per cent month-over-month in January, leading to a 55 per cent decline over the past year.

With the rise in new listings, buyers have more bargaining power, and Hogue expects that will keep driving prices down in the coming months.

The MLS HPI has declined by 12 per cent since March 2022. RBCsays single-detached homes are most at risk of losing further value, while condo prices are expected to be supported by stronger demand.

Calgary

Calgary continues to buck the national trend. Hogue says the city stands out as the tightest market in Western Canada.

Despite 11 consecutive months of declining home resales (down eight per cent in January), activity remains 32 per cent above pre-pandemic levels. Hogue notes a sharp drop in new listings may have contributed to the decline last month.

According to the report, the MLS HPI remains above year-ago levels but “probably not for much longer.” The index has trended lower since May 2022, and Hogue expects this to continue in the near term.

Download the latest RBC special housing report here.

Fac

What’s the forecast for the Red Deer Alberta housing market

What is the forecast for the Red Deer Alberta housing market for spring 2023

There’s more to Canada than Van, Calgary, TO and Montreal. What do the numbers look like for Atlantic Canada, that is NS,NB,PEI,NL???

It would be good to know.

I couldn’t agree more. The cities mentioned above are the cities covered in RBC’s report.

Not sure where the author is getting their numbers but Vancouver is experiencing historically low supply right now and my listings are selling in multiple offers. Probably not a good idea to be putting out errant information….

Fall 2023 will see the record low 🔅

Hi interest rates having big effect on economy slow down, everybody’s gonna claim bankruptcy soon if these rates don’t come down. People are drowning in debt because of government policies.

Hi interest rates having big effect on economy slow down, everybody’s gonna claim bankruptcy soon if these rates don’t come down. People are drowning in debt because of government policies.